After that compromise was worked out, those working to draft the Constitution were in no rush to tinker with it. Daley, but its passage was still a hard-fought battle in the legislature.

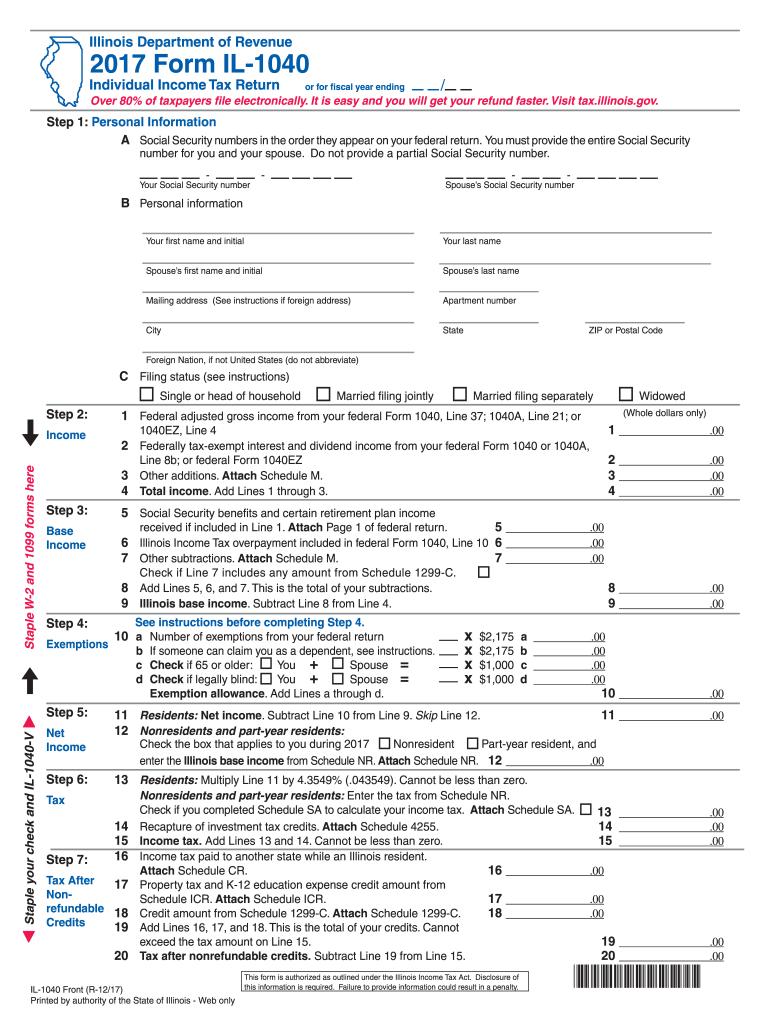

The proposed income tax, which was flat and taxed individuals at a 2.5 percent rate and corporations at a rate of 4 percent, was supported by the Republican Ogilvie and Democratic Chicago Mayor Richard J. The state was facing a deficit of more than $1 billion. The fiscal situation at the time will sound familiar to those who follow Illinois politics today, although much less dire. Richard Ogilvie signed the tax into law in 1969. When the framers of Illinois’ Constitution, which was adopted in 1970, were considering the revenue article, the state’s income tax was practically brand new.

The reasons can be traced to the state’s first-ever successful attempt at putting an income tax in place.Īn effort to change the current tax structure is underway, but supporters face a fast-approaching deadline.

Illinois is one of only eight states with a flat income tax.

0 kommentar(er)

0 kommentar(er)